Tax Withholding For 2024 – Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. . As we previously discussed, young people new to the full-time work force can be vulnerable to incorrect tax withholding. While it is too late to adjust 2023 tax withholding, it is a perfect time .

Tax Withholding For 2024

Source : www.forbes.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comEmployee’s Withholding Certificate

Source : www.irs.govIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

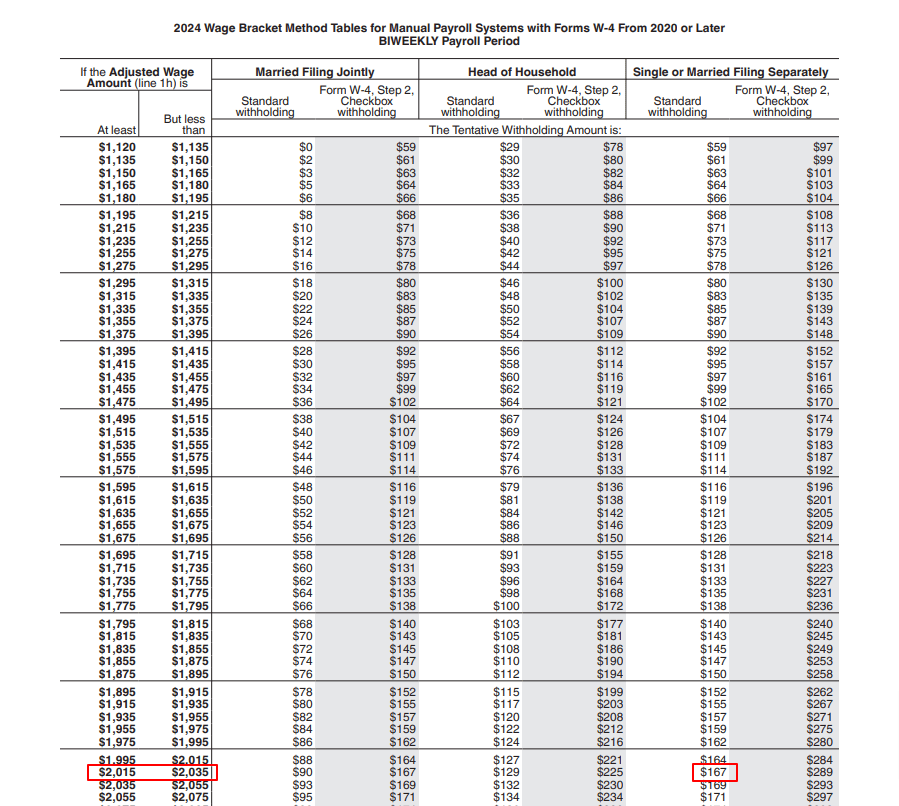

Source : www.nerdwallet.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comWhat to Know About 2024 Tax Withholding and Paying Estimated Taxes

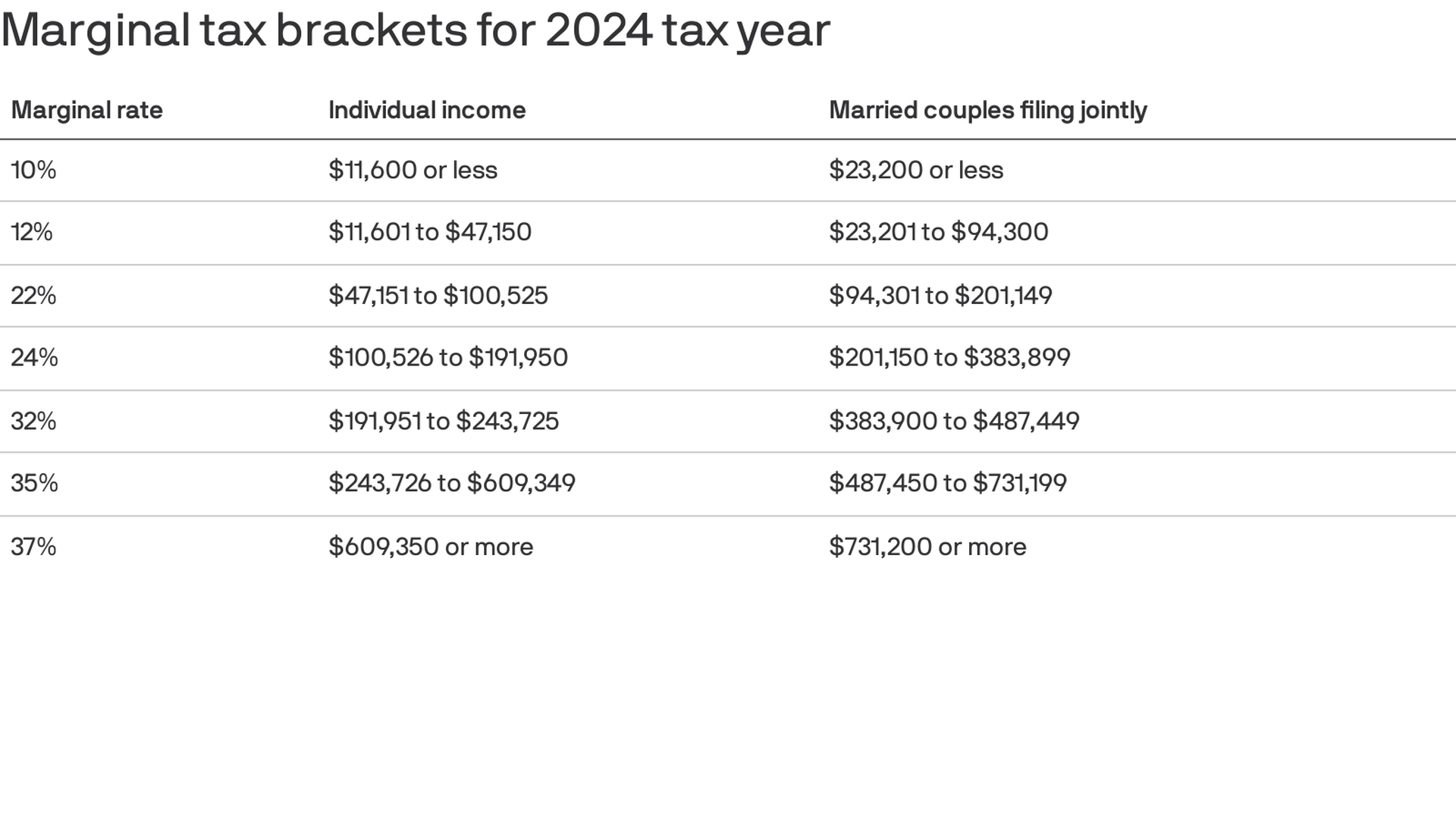

Source : www.wsj.com2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.comIRS 2024 tax bracket changes may make your paycheck slightly bigger

Source : www.cnbc.comFederal Income Tax Brackets For 2024

Source : thecollegeinvestor.comTax Withholding For 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Your refund is money that rightfully belonged to you all year long that the IRS has been collecting and holding. . Chicago-based certified public accountant Daniel Rahill told USA Today that early filers may be receiving smaller refunds because they did not increase their tax withholding amounts despite .

]]>